How many times has it happened that your customers asked to pay online and you failed to accommodate their needs?

Quite often?

Are you not accepting multiple payment methods and that’s hurting your bottom line?

If yes, then you need to adapt to systems that will enable you to accept different payment methods, especially digital payments.

In fact, according to Statista, the global transaction value for digital payments is $5.2 trillion in 2020 with 63% coming only from digital commerce and 30% from mobile POS systems. And as per Business Standards, data says there is a 29% annual growth of digital payments in March 2022.

These above figures emphasize considering the different channels of accepting payments for better customer retention.

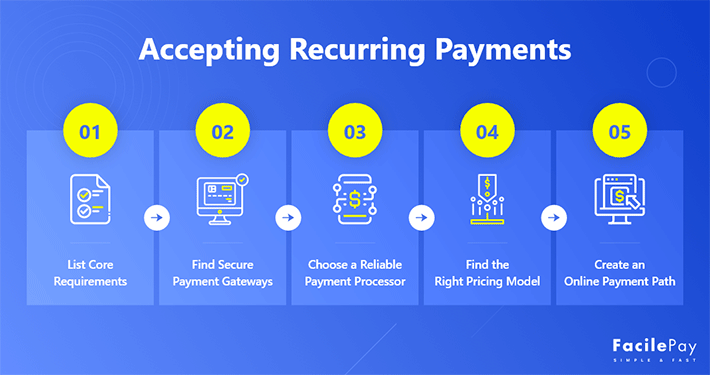

In this blog post, we have drafted the steps to accept recurring payments online. This article will also provide insights into the best payment processors.

So, let’s start right away.

Contents

5 Steps to Accept Recurring Payment

Recurring payment is the center of attraction for businesses because of the tremendous success this model has given to brands like Netflix, Dollar Shave Club, and Adobe. However, the type of payment structure you adopt will depend on your unique business needs and goals, and not on the success experiences of others. You should make a comparison between one time payment and recurring payments to evaluate and understand the best fit for your business.

Do you still find to set up recurring invoices the best model for your business to scale and grow faster?

Well, if you want to leverage the most out of the recurring payments model, you will require a guided roadmap to get started rightfully.

The steps below are a guide for every business, irrespective of its shape, size, and category. If you want to avoid the risk of financial loss and scale faster, this guide to set up recurring payments and accept online payments will work for you greatly.

Let’s dive in to discover the 5 steps of accepting recurring payments online.

-

List Down Your Core Requirements for Accepting Recurring Payments

- What is the average ideal age of your targeted customers?

- What is the preferred payment mode of your targeted customer base?

- What are the basic concern areas of your customers with regular payments?

- How are your customers located geographically?

- Which payment gateways, cards, google pay, apple pay, and banks are in use among your customer base?

- If your customers are in the age group of 18-38, you would need to accept fixed payments or credit card payments online for enabling convenience and better customer retention.

- Similarly, if your customers are located in different countries, you will require to collect payments online and in multiple currencies.

- Is your move to recurring payment services driven by customer retention?

- Do you want to minimize the churn rate for your business?

- Are you willing to have a steady cash flow?

- Are you willing to accept recurring invoicing payments in different methods?

- Do you wish to adopt a strategy that can eliminate failed or missed payments due to the expiry of credit and debit cards?

- Have you been looking for a payment provider or want to build your own automated payments system?

-

Research and Find the Most Secure Payment Gateways to Use for Recurring Payments

- Check the most secure payment gateways based on their compliance standards

- Perform a comparative analysis of the pros and cons of the payment gateways you found to be the most secure as well as your top competitor models

- Evaluate the features and understand how the gateway can help your target customers and provide them with convenience and security

- List down the negative reviews of your competitors with payment gateway

- Make an informed decision with a well-understood outline of the features and benefits of the payment gateway chosen

- Provide multicurrency payouts

- Lets you accept debit cards, credit cards, ACH payments, and digital wallets with single integration worldwide

- Enables retrying failed payments on autopilot mode

- Highly secure (compliant with the Payment Card Industry Data Security Standards)

- Easily customizable checkout flow

- Flat-rate pricing with no setup, cancellation, or monthly fees

- Can be difficult to use without professional software development expertise because of its open API module

- Limited in terms of functionality for in-person or store businesses

- Support 150 payment methods enabling you to accept cards, and online payments from different banks

- Enable accept payments from multiple currencies including USD, EUR, AUD, GBP

- Help generate online payment link

- Secured with PCI-DSS compliance standards

- Pay-as-you-use model with flat-rate costing of 2% + 18% GST per transaction for domestic usage and 3% + 18% GST per transaction for international usage

- Due to high-security standards, the system creates payment laggards that increase the timeline of transactions

- Limited in terms of features for accepting payments for a wide range of business types

-

Choose a Reliable, Efficient, and Feature-rich Recurring Payments Software

- Will there be an automated process to retry failed payments?

- Does the processor support different retry cycles for soft/hard declines?

- How feasible is it to make manual edits to invoices and their line items?

- Does the payment types can manage trials, discounts, and promotional vouchers for a configurable duration?

- Will there be tracking reports on subscription upgrades and downgrades?

- How easy is it to reactivate recurring series or recurring invoicing in the system?

- Is there an automated intimation of invoices over email and mobile?

- Will the system allow you to manage taxes?

- Does it support recurring payment plans that vary based on pricing, billing or invoicing period, contract length, and include benefits and add-ons?

- Will there be any custom solutions for specific needs or requirements?

- What payment modes does it accommodate?

- Will it provide a detailed health report of the finances?

- Regulate and streamline the billing cycles of each customer for your subscription business

- Get to automatically charge customers and accept payments as per the billing logic

- Eliminates administrative costs on the monthly payment and recurring revenue

- Minimizes manual inefficiencies

- Aligns tax management tasks

- Helps you to accept payments from different countries and currencies

- Broadens your market reach for recurring revenue

- Enable you to set and configure flexible billing logic for varying prices, invoicing period, benefits, discounts, and add-ons

- Helps to extend your subscription services for multi-year plans

- Process payments online with stringent security and compliance standards like PCT DSS (Payment Card Industry Data Security Standards)

- Ensure your customer’s payment information doesn’t get stored and misused

- Makes signing up for your subscription services reliable and risk-free

- Helps get an overview of your financial transactions including missed payments, upgrades/downgrades in subscription plans, and payment failures

- Enable you to track your churn rate whether voluntary or involuntary

- Works as an easy-to-use accounting software that helps track subscription details, payments that happen monthly, billing, and taxes

- Enable you get cost modules for requirements that are specific to your business and ideal customers

- Gives you the flexibility to go beyond the provided features of a payment processor

- Helps you maximize your potential with billing and payments processing

- Helps you accept payment in any form whether debit card, credit card, ACH payments, or online transactions

- Eliminate the challenges of losing customers

-

Decide on the Pricing Model that Works for You

- Package model with four plans (Lite, Plus, Premium, Select Custom).

- Costs range from $6 per month to $22+ per month.

- Custom pricing varies depending on the feature requirement.

- Package Model with primarily three plans (Free, Plus, Premium).

- The cost range starts at $29+ per month + processing fees.

- Provide pricing plans by business types such as restaurants and retail stores.

- Flat-rate fixed price model.

- It charges 1.25% per transaction with no additional or hidden fees.

- Add-on pricing model with three plans (essential, growth, scale).

- The cost range starts from $599 per month with +1% on additional billings.

- Provide the scope to upgrade the plan and add-on features from higher packages.

- Package model with five key plans (free, basic, standard, professional, enterprise).

- The cost starts from 999 INR per month.

- Provide custom pricing plans for additional features.

-

Create a Way for Customers to Pay You Online

Recurring payment schedule is usually processed through customers card, and ACH payments. There are some processors that even provide a direct debit feature for this model. You should choose software that can help you with every kind of mode for automatic payments.

When you accept fixed recurring payments (direct debits), you eliminate the possible churns happening because of credit/debit card expiry. It boosts your customer retention rate which ultimately helps you grow your business.

Examples of payment processing softwares that helps accept recurring payments via direct debits and also enables create separate online payment links are listed below.

When you think of opting for recurring payments, the first thing is to create an outline of the requirements. And, how to create an outline? It’s simple, you need to do some self-evaluation and find out why you require an automated payments model to support your business.

To start finding and listing down your requirements to accept recurring payments, answer the below questions:

Answering these above questions will give you a clear path and idea of your requirements to accept recurring payments.

For example –

In addition to evaluating your customer’s preferences with payments, you also need to reconsider your primary or core agenda for recurring payment processing. Below are some questions you need to reconsider answering yourself before concluding your requirements list.

These are some basic questions that will help you create an outline of your requirements to start with recurring payments. This pre-defined requirement list will make your decisions in the further process simpler, risk-free, and cost-effective while maximizing the opportunity for small business owners to scale and grow.

Once you are done listing down your requirements to accept recurring payments, you should now do some research and find the best payment gateway in the market. For example – Stripe and PayPal.

The research will help you identify the market trends of payment gateways, map competitor models, and understand their payment processing systems.

But, how do you conduct this research? Where to start?

Well, don’t worry, you just need to follow the below checklist to make this research.

A payment gateway plays a vital role for businesses to accept payment online. A gateway works as a system in the middle that encrypts and securely sends data to payment processors.

Hence, evaluating and marking down the best payment gateway for customer payments is very important to make the right choice of recurring payment platforms.

Here are two examples for you to understand the type of analysis to perform for your particular business model and customer base.

| Pros | Cons | |

|---|---|---|

| Stripe |

|

|

| PayU |

|

|

Once you are done with Step 1 and Step 2, you will then need to find a secure and efficient recurring payment platform. The first two steps are for you to create a base for the search of a reliable software to process recurring payments.

When looking for subscription payments software, you should get answers to the following questions below.

When trying to figure out the best payment processing services tool or software, getting answers to the above questions will help you evaluate the basic and advanced features efficiently. Additionally, you should choose a software that will efficiently help you to overcome the difficulties faced in recurring billing and invoice processing.

However, in order to make it easier for you to get an overview of the typical features of a recurring payment processor, we have created the below table. This table will cover the typical features of an efficient payment processor with its core benefits.

| Features | How Will You Benefit? |

|---|---|

| All-in-One Recurring Billing Solution |

|

| Multi-Currency Support |

|

| Multi-period Billing for Subscription Payments |

|

| Secure Payment Processing & Checkout |

|

| Improved Subscription Management With Advanced Payments Report |

|

| Custom Pricing Solutions |

|

| Accept Different Payment Methods |

|

When deciding on the payment processor, you need to also evaluate their pricing models and finalize what works for you. You must consider the requirements list created in step 1 and the payment gateway chosen in step 2 while concluding the pricing model.

To help you, we have listed down some of the best payment processors with their pricing model details. Choose the type of payment method that fits your needs.

| Payments Processors | Pricing Models |

|---|---|

| FreshBooks |

|

| Square |

|

| FacilePay |

|

| Chargify |

|

| Zoho Subscriptions |

|

There are many more payment processors apart from the ones mentioned above. Pick and choose the one that can meet the requirements you have listed in step 1.

-

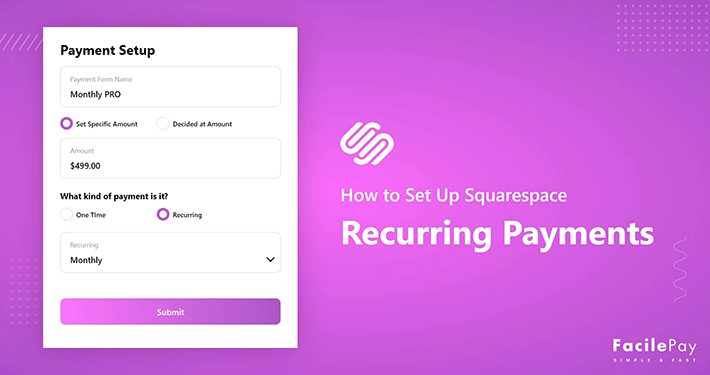

FacilePay

-

GoCardless

-

Square Invoices

FacilePay app processes recurring payments using Stripe that enables you to make transactions via every mode whether credit/debit cards or direct debits. You can also generate online payment links using this payment app.

GoCardless is a payment processor that helps accept payments online whether one-off or recurring. This app is a solution specifically created for accepting recurring payments online (direct debits).

Square Invoices is yet another recurring payments processing software that has the direct debit feature. This is recognized by Forbes among the top recurring payments software.

Now you know the steps to follow when starting out with the recurring payments model. The steps aim to not just guide you but also help you know the optimal ways of utilizing this payment structure. Let’s move on to answer some common questions.

Frequently Asked Questions About Accepting Recurring Payments Online

-

How does direct debits work with recurring payments?

Direct debits are a method that processes recurring payments to get debited through customer’s bank account instead of credit/debit cards. The process works very simply.

- You add the bank details like name of the account holder, account number, IFSC code, linked email id, and bank name into the recurring payments software

- Schedule the payment for debit as per the billing logic or decided amount and time

- Accept payments for each schedule with no additional work

-

Is there any upper and lower limit for processing recurring payments?

Yes, card-based recurring payment transactions have an upper and lower limit. But, the amount varies based on the card type (for example – Visa, MasterCard, and RuPay), bank, and region.

Note: This is not applicable to direct debits or ACH payments.

-

How much time does it take to process recurring payments?

The average time to process recurring payments varies depending on the type of software you use and the kind of payment gateway integrated. For most softwares, the time to process recurring payments is 7-8 business days.

Note: This timeline is for processing recurring payments as per the billing logic that includes initiating automated notifications for customers and does not imply the actual transactions.

Ready to Accept Recurring Payments Online?

At first, it may seem overwhelming for you to understand the entire process it goes into incorporating the recurring payments model in your business. But, once you start getting your payments processed using this model, you will realize your efforts are worth it.

There can be nothing better than adapting to technology solutions that make life simpler for your employees and customers simultaneously. After all, who wouldn’t want to boost productivity and delight more customers at the same time?

If you are looking for a reliable and efficient recurring payments processor to leverage this payment mode, you can consider using the FacilePay app.