Are you experiencing a high churn rate due to payment errors?

Do you want to maximize the cash flow to attain stability for your business?

Have you been struggling to manage your business finances?

Do you find it a struggle to track transactions and tally your revenue and sale?

If yes, you have come to the right blog.

Recurring payments can be a great solution for you to streamline your revenue stream, manage financial records, and attain higher customer retention.

But, how does signing up for recurring payments work to resolve the above challenges?

Let’s find out the answer to this by taking a detailed look into the benefits of recurring payments with examples of businesses leveraging this model to its maximum.

But, before moving to the benefits, let’s first take a short look at what are recurring payments.

Contents

What Are Recurring Payments?

Recurring payments are a periodic method of charging customers’ credit cards or debit cards on an agreed schedule (often weekly, monthly, quarterly, and annually). With this payment method, revenue collection becomes easier and efficient.

Recurring payments reflect an ongoing commitment to your business by those who matter the most – your customers.

There are broadly two types of recurring payments, namely:

- Fixed recurring payments – This involves charging customers the same amount at every schedule. For example – Magazine subscriptions, netflix subscriptions, amazon prime subscriptions, newspaper subscriptions, and gym memberships.

- Variable recurring payments – This involves a usage-based collection of payments where the amount changes on each payment cycle. For example – Utility bills such as gas connections and electricity connections.

As you got a clear idea of the basic meaning of recurring online payments. Now explore the top benefits of recurring payments and understand how you can leverage this model.

7 Benefits of Recurring Payments You Should Know

The progression of technology has fueled the growth of SaaS solutions for collecting payments.

While the very basic feature of this payment model is an automated revenue cycle with the associated benefit of reduced manual errors, it is just halfway to the full story. There are several more features of recurring payments with lucrative benefits that can help businesses of all types and sizes.

Here we have listed the top 7 benefits of this payment solution for the subscription business model.

-

Scale Higher with Predictable Revenue and Steady Cash Flow

- Identify and create mitigating plans for potential cash gaps

- Identify and allocate cash surplus

- Check unnecessary outflows or expenses

- Plan out for unknown business risks

- Plan for financial backups

-

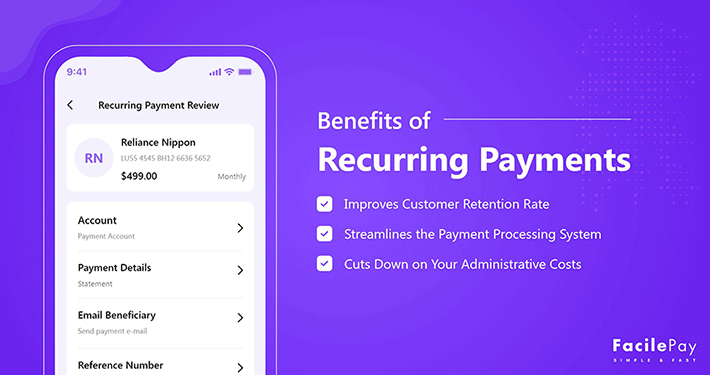

Improves Customer Retention Rate

-

Tracks Subscription Payments With Real-Time Reports

-

Streamlines the Payment Processing System

-

Manage and Monitor Churn Rate Easily

-

Reduces Risks and Improves Stability for Your Business

-

Cuts Down on Your Administrative Costs

Once recurring automated payments are set up, businesses can better predict cash flow. Such predictability of revenue helps to:

Use recurring payments as one-size-fits-all solution for businesses to streamline their revenue collection process and make income and expenses more trackable. Executing recurring payments for small businesses works best to scale with clear revenue projections. What more than a steady cash flow would any business want for stability?

To every business, its customers are valuable. Thus, business decisions are often customer-centric in nature. Recurring payments work greatly to improve customer relationships. Recurring billing brings cost convenience for customers and also greatly improves the overall payment process.

A healthy and happy customer relationship creates loyalty, reduces churn, increases the value of each sale, reduces the cost of customer acquisition, and also helps gain more business through referrals.

Example:

1. Disney+

Disney+ is leading when it comes to customer retention for most subscription services as per the latest July 2022 report by Bloomberg Second Measure. A six-month data report on Disney+ subscribers shows that it maintains a 78% retention rate for its bundle plans. The success to retain customers largely happens because of the company’s strategic approach to recurring payments and its subscription service.

2. Netflix

While Disney + has acquired a good customer retention rate, Netflix isn’t far behind. As per Bloomberg Second Measure, Netflix maintained its retention rate of 74% amid all the competition. In fact, a Statista report says that Netflix has received a revenue growth from $1.36 billion to around $26.7 billion in just 12 years. Additionally, it has 220.67 million active paying subscribers at present.

The recurring payment model helps track and understand what customers consume and make upgrades that work as the best retention practice for businesses.

Having a recurring payment system in place helps businesses to track their subscriptions and revenue with advanced reports that give far more detailed insight than balance sheets.

Moreover, recurring billing and subscription payments through automated systems help identify gaps. This is usually not recognizable with manual accounting systems.

Additionally, you get to instantly resolve the gaps before they become a burning problem for the business. This largely controls challenges like errored billing cycle, late payments or missed payments, and a smoother billing process.

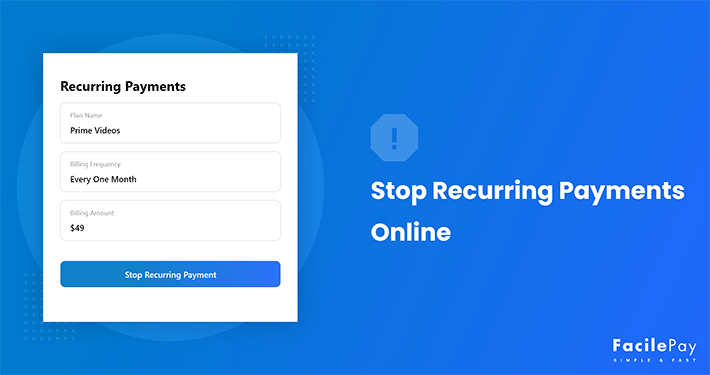

When you put the revenue cycle of your existing customers into autopilot mode with a recurring payment models or software, all you have to do is set up the initial schedule for accepting recurring payments. Then just simply manage payment automation.

You can make changes to the ongoing payments as and when required to do so. Collecting recurring payments is easy and quick. What more can a business ask for?

Implementing recurring payments into your business operations helps manage churn rates better. Businesses can easily track down their voluntary and involuntary churns and frame solutions to control the rate before it grows out to become a major challenge for the business.

When you accept payments on a recurring basis, you are more in control of your actions and strategic business decisions.

When you sign up for recurring payments, you are able to minimize risks for your business and improve stability for it.

When you accept recurring payments, you are able to have a steady flow of income and predictable revenue generation for now and the future. This benefits with fewer revenue fluctuations, less number of unexpected losses, and a long-term value-based relationship with your customers. So, do you want steady cash flow and attain stability?

Recurring billing and payments systems helps control the challenges like failed payments, missed payments, and late payments that eliminate late fees and other administrative costs. This system works best when you and your customer agree to engage in a long-term billing cycle or financial agreement.

Recurring payments largely help businesses with a subscription model to streamline their payment process and cut down expenses in administrative areas.

So, now you have a complete idea about recurring payments and how you can leverage the maximum from this model.

If you still have doubts, then let’s try to get them answered in the FAQ section.

Frequently Asked Questions

-

Who can leverage the most out of recurring transactions?

The recurring payment model is great for every business but it particularly works beneficial for those categories of businesses who regularly invoice the same customers for an identical bank account. This revenue processing system will save a huge amount of time for businesses and will make their accounting accurate and efficient. This method brings control into the accounting system at an ease.

-

Which are the best recurring payment service providers of 2022?

There are many providers of recurring payments who offer a varied number of features making the life of the finance professionals of your business simpler. But, there are few who have garnered a heavy amount of popularity and recognition.

Here are the top 4 recurring payment providers in 2022.

- Freshbooks: This software has easy-to-use accounting and bookkeeping features that include invoicing, expense management, time tracking, payments automation, reporting, and accounting. Freshbooks is rated 4 stars on Android and Apple stores having more than 14k users.

- Zoho Subscriptions: This is another leading subscription billing software with features like payments automation, an integrated billing suite, analytics or metrics dashboard, and a tailored subscription experience system. Zoho has received a 4+ rating on Android, GetApp, and Capterra.

- ChargeOver: This is yet another software with rich features like automated recurring billing and payments system, an easily customizable payments module, and advanced business and payments metrics. ChargeOver is 4.4 rated by Forbes Advisor.

- FacilePay: This is a recurring payment app for businesses of all sizes with features like multi currency support, enabled with direct debits, and PCI DSS compliant. FacilePay is rated with 4+ stars on Android and Apple stores and is trusted by 1.6k users.

-

How does recurring payment work?

Recurring payments work very simple as it is completely an automated process. However, you need to do some work to begin using this model. Below is a step-wise guideline for you.

- First, list down the basic requirements of your customers and business

- Select the type of payment gateway you want to use like Stripe, PayU, and Paypal

- Choose and pick a payment processor or recurring billing and payments software

- Decide on the payment model for the processor

- Finalize the payment processor

- Complete the basic sign up requirements and set up your recurring payment schedule for customers

- And, you are done as the schedule will automatically repeat and payments get collected without you doing anything

Want to Sign Up for a Recurring Payments Software?

Having the complexities in place with invoicing and payments, it requires signing up for a solution that can minimize the challenges and make finance operations better and more efficient. Recurring payments have the capacity to minimize accounting, billing, and payments-related challenges. But, you need a good strategy and a reliable provider to leverage the most out of this payment model.

When choosing a provider, you should always consider aspects like adaptability to multiple payment methods, automatic billing with advanced reports, multi-currency support, and secured payment infrastructure (do not store any payment information).

Consider choosing the FacilePay app. Here you will get an all-in-one solution to all your recurring billing and payments problems.