- The best international payment gateways offer multi-currency support, fraud prevention, and easy integration with your website.

- Stripe, PayPal, and Authorize.net are among the top international payment gateways for small businesses.

- Adyen and Braintree are recommended for larger businesses with high transaction volumes.

- Consider your specific business needs and transaction volume when choosing an international payment gateway.

📝Key Takeaways:

An international payment gateway has become essential to acquire a wider audience and expand business worldwide. Payment gateways allow customers to pay and merchants to receive their payments from different countries and regions.

In fact, many companies have started integrating payment gateways to explore new markets and increase revenue. Moreover, according to the Research and Markets report, the global payment gateway market is forecasted to reach $132.24 billion and a CAGR of 22.1% from 2022 to 2030.

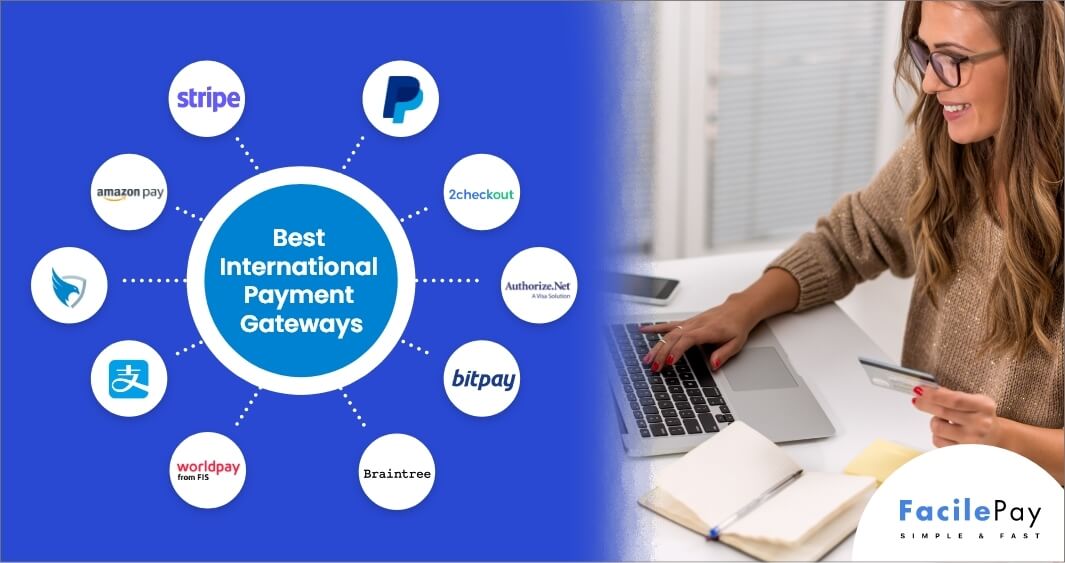

However, you will find numerous international payment gateways in the market, and choosing the right one is confusing. Well, to make it simpler for you, we have curated the 10 best international payment gateways to upscale your business sales and expand globally.

Contents

What is the International Payment Gateway?

An international payment gateway is a tool to make and accept payments from around the globe. It acts as a bridge between the merchant and the payment processor.

Moreover, it is a secure and convenient way for businesses to receive payments from customers using multiple payment methods, such as credit cards, debit cards, digital wallets, and bank accounts.

Top 10 International Payment Gateways

Here is the list of the top 10 international payment gateways that make international payments seamless.

1. PayPal

PayPal is an online payment system that offers international payment gateways service for merchants. It is one of the oldest and best payment gateways for supporting over 100 currencies efficiently. PayPal offers secure transactions, invoicing, recurring payments, and fraud transactions.

It is a PCI-compliant international payment gateway provider. The online payment gateway serves 200 countries and offers free standard withdrawals and no fee for donation and fundraising.

Pricing – If you are paying it will cost you 3.49% + fixed fee, and for receiving it will be 1.50%. The pricing is different for paying and receiving.

-

Features:

- PayPal allows you to pay by scanning the QR code of the seller.

- It uses encryption and protects the sensitive information of customers.

- PayPal allows transactions using cryptocurrencies.

- It provides instant payouts with the help of linked bank accounts.

- International payment support– Over 200 countries support PayPal for international payment.

- Buyer protection policy– PayPal offers a policy securing all eligible purchases.

- Instant chargeback – If something went wrong in transactions, PayPal returns your money instantly.

- Transaction money– The fee can be high for certain international transactions.

- Prompt Cash– PayPal will charge you a 1% fee if you want urgent access to your money.

2. AmazonPay

AmazonPay is an international payment method by Amazon. It allows merchants to accept payments from customers using their Amazon accounts. Thus, it simplifies the checkout process for customers.

Also with AmazonPay, merchants will be able to reach a wider audience with the trust and convenience of the Amazon brand. By Amazon service, businesses will provide a smooth and suitable experience for customers for transactions.

Pricing– AmazonPay charges 9% + $0.3 per transaction inside the USA.

-

Features:

- AmazonPay allows businesses to accept payments of different currencies.

- It lets multiple users access and manage a single business account.

- AmazonPay provides businesses with detailed reporting and analytics on their sales.

- It enables third-party users to pay on different websites using Amazon Pay services.

- Setup fee– AmazonPay has no setup or monthly; just pay only per transaction.

- Secure payment– It has the ability to store payment information securely.

- Multiple usages– It can be used on multiple websites for different purposes like bills.

- Specific countries– It is supported in limited specific countries only.

- Restrict customization– It has limited customization options.

3. Stripe

One of the renowned methods to collect international payments is Stripe. It is designed for all sizes of businesses and provides access to large customer bases with the ability to accept payments from customers across the world.

From startups to well-established enterprises, Stipe helps your customers to complete their purchases in a few clicks. The solution handles primary functions, such as storing cards, direct payouts, and subscriptions to user bank accounts.

Pricing– Stripe charges 9% + 30 cents on international cards or currency conversion.

-

Features:

- Stripe supports payment in over 130 currencies and is available in 47 countries.

- It is easily integrated with e-commerce platforms, such as WooCommerce, Shopify, and Magento.

- It allows creating online invoicing with no extra charges.

- Stripe has an API-based payment method that allows accepting various payments with one API.

- Prevent fraud– Stripe uses machine learning as a fraud detection tool to protect businesses from financial loss.

- Secure process– It keeps both business and customer information safe.

- Customer support– It offers 24/7 customer support through phone, email, or text.

- Complex interface– The interface of Stripe is difficult to navigate, especially for non-technical experts.

- Limited market reach– Challenging for payment processors to perform transactions with international customers.

4. 2Checkout

The 2Checkout (2CO)is a payment gateway for international customers. It is an international gateway provider by VeriFone. 2CO offers recurring billing, multiple languages and currencies, and customization.

With easy integration and secure payments, 2Checkout is a solution that accepts payments from over 200 different markets. Moreover, it does not have monthly or annual fees; so, it is affordable for businesses.

Pricing– 2Checkout charges 3.5% + $0.35 and 6.0% + $0.60 for global plans.

-

Features:

- The platform provides recurring billing for subscription-based businesses.

- It supports payments in over 87 countries

- 2Checkout accepts payments through numerous methods, such as credit and debit cards, PayPal, and bank transactions.

- It offers a customer management system that allows businesses to track purchase and billing information.

- User-friendly interface – 2Checkout has a user-friendly interface that helps to navigate the payment system easily.

- Safe encryption– It uses excellent SSL encryption to protect sensitive information.

- Reporting and analytics– With 2Checkout real-time reporting and analytics, you will be able to track sales/ revenue efficiently.

- Limited customization– 2Checkout customization options are limited to meet business needs and accept payment.

- Restricted integration with accounting software– It has limited integration with accounting software which makes accounting and bookkeeping challenging.

5. Authorize.Net

The international payment gateway provider helps businesses to process credit payments efficiently. Moreover, Google pay, Amazon pay, Apple Pay, and PayPal can also be used for transactions.

Authorize.Net is a secure and reliable platform that helps to manage transactions, accounting setting configuration, generating reports, and analyzing account statements. It has numerous third-party points of sales and virtual points of sales.

Pricing– Authorize.Net charges $25 + 1.5% per transaction fee.

-

Features:

- Authorize.Net supports a wide range of payment methods, including electronic checks, debit, and credit cards.

- It accepts and submits monthly recurring or installment payments with its easy recurring option.

- Authorize.Net allows you to keep card information up-to-date so you don’t miss any payments or experience sales interruptions.

- The platform includes a virtual terminal for processing payments over the phone or via mail orders.

- Efficient APIs– It provides friendly and efficient APIs to integrate a payment solution with other applications.

- Secure management– It offers customer information management that helps to store credit card information securely.

- Customer support- It has 24/7 customer support that helps to resolve issues quickly.

- Monthly fee– It has a monthly fee, which might be expensive for startups or small businesses.

- Recurring payments– For a few businesses, setting up recurring payments are challenging because of restricted features.

6. Braintree

It is an online payment solution that focuses on streamlining transactions. It helps organizations to accept payments, drive business growth, and develop businesses with its global commerce tools and features.

It is supported by over 40 countries and lets you receive transactions and split payments in over 130 currencies. Moreover, it is equipped with an easy-to-use payment API for the web and provides customization that makes payment more convenient.

Pricing– Braintree charges $49 monthly and has 2.9% + $0.30 per transaction fee.

-

Features:

- Braintree offers advanced level 3D security, an additional layer of verification for fraud protection.

- It allows you to checkout easily with its drop-in user interface and third-party integration.

- Braintree provides a customer vault for storing payment information for future transactions securely.

- The web payment system allows you to accept payments through Venmo, ACH transfers, credit card payments, bank transfers, and digital wallets.

- PCI compliance– It meets the Payment Card Industry Data Security Standard (PCI DSS) that secures transaction information.

- The volume of transactions– Braintree allows to handle large volumes of transactions and is scalable to meet business needs.

- Merchant base– It has large merchant base support that helps businesses to expand their network.

- High price– Braintree is more expensive compared to other payment systems.

- More glitches– It uses lots of RAM which causes too many glitches in the payment process.

7. BitPay

The online payment service is different from other international payment gateways. BitPay allows businesses to accept bitcoin payments or direct deposits in their bank accounts. It is an all-in-one solution for bitcoin payments and transactions.

Additionally, it offers two-factor authentications, direct bank desport, exchange rates, and customization. BitPay is available in over 38 countries and allows payment through multiple currencies.

Pricing– BitPay charges a $26 fixed fee per transaction regardless of any rate.

-

Features:

- BitPay allows crypto payments, donations, deposits from customers globally.

- It supports third-party integrations, such as Shopify and Magento seamlessly.

- BitPay allows you to create automated invoices to your customers and streamline the billing process.

- The wallet software protects you from costly chargebacks with its multi-signature wallet.

- Less fee– BitPay has a low transaction fee compared to traditional payment gateways.

- Faster process– The payment process is faster, which helps businesses to improve cash flow.

- Additional setup– No requirement of additional setup to receive payments.

- Complexity– It might be challenging for businesses that are not familiar with cryptocurrency.

- Volatility– The value of cryptocurrencies is volatile which can increase risk in payment transactions.

8. WorldPay

WorldPay is a payment processing solution for international payments. It allows us to meet various requirements of different types of business. The tool allows business customers to pay through credit cards, online gateways, or cheques.

It is available in 146 countries and has access to 126 currencies for international payments. It is an integrated payment page and hosted pay page that helps business’ customers to complete payments without redirecting to other pages.

Pricing– Worldpay standard plan charges $22.85 for transactions and the advanced plan charges $54.11 per transaction.

-

Features:

- WorldPay integrates with numerous point-of-sale systems, making it easy for businesses to accept payment in-store.

- It supports over 120 currencies and allows businesses to accept payments from customers around the world.

- The international payment gateway providers offer real-time fraud monitoring that reduces the risk of fraud.

- WorldPay offers e-commerce payment management that allows customers to link the payment URL with the online basket.

- Daily report– WorldPay allows generating daily reports that help businesses to track transactions.

- Customizable receipt– The businesses will be able to create customized receipts that match their needs.

- Automated reconciliation– WorldPay’s automated reconciliation process reduces risk of errors by allowing it to match a bank’s statement.

- Limited crypto support– WorldPay only supports traditional flat currencies and not cryptocurrencies.

- Transaction size– It does not allow large transactions and has limitations on the size of transactions.

9. SecurionPay

The online payment platform is popular for secure payment systems. It supports widely used operating systems, such as Windows, Mac, Android, iOS, and Linux. SecurionPay is integrated with multiple business systems and applications, which makes it convenient for businesses.

It has high functionality and allows auto-renewal features to hassle-free payment transactions. SecurionPay is the only tool that offers additional layers like blacklisting to protect information.

Pricing– Securionpay charges 2.95+ 0.25 per successful transaction and for high-risk merchants, it charges 4.9%+0.35 per transaction.

-

Features:

- SecurionPay uses tokenization to protect customer information and reduce data breaches.

- It supports multiple billing options, such as subscription, one-time payments, and mixed billing.

- SecurionPay offers a terms and conditions checkbox, easy to translate multi-language, and a confirmation message to ensure successful payments.

- It lets businesses set up automated recurring payments to simplify the billing process and reduce payment errors.

- Secure authentication– It offers non-invasive 3D that helps minimize the chargeback ratio with advanced PCI.

- Integration with accounting software– It integrates with accounting software, such as QuickBooks to reconcile payments.

- Customer support– It helps customer support to resolve issues.

- Limited customization– It offers limited customization options to process transactions.

- Dependence on third-party processors– The global payment processing solution relies on third-party processors to manage payments.

10. Alipay Global

The last one on the list of the best international payment gateway is AliPay Global. It is formed by Alibaba and provides international merchants access to the global market. It is a suitable option for advanced businesses, such as cashless taxis.

However, it supports only 12 currencies. In addition, AliPay Global offers secure transactions, easy integration, and streamlined international payment processes.

Pricing– Alipay charges 0.55% per transaction as a merchant fee.

-

Features:

- Alipay offers a digital wallet, allowing businesses to accept payments easily and rapidly.

- It enables cross-border payments, allowing merchants to build a customer base and expand sales globally.

- It offers a virtual debit card that allows access to funds anywhere and anytime with no additional setup.

- It provides real-time exchange rates that help businesses to handle international payment transactions.

- QR code– AliPay uses QR code for payments that makes transactions faster.

- In-app process– With in-app purchase features merchants can offer a seamless buying process to increase customer engagement.

- Automated receipt– Alipay Global’s virtual receipts provide a conveniently accessible record of transactions for businesses.

- Limited reach– It has a limited market reach and is not available in many countries.

- Fewer payment options– AliPay global provides limited payment options which cause inconvenience for global transactions.

Which International Payment Gateways is Best for Your Business?

A good international payment gateway would be as efficient as local payment methods. When choosing an international payment gateway, businesses should consider the following factors-

- Payment methods supported: Businesses should determine a gateway that supports the payment methods their customers prefer to use.

- Security measures: You should ensure that the gateway provides robust security and advanced technology to protect essential information.

- Fees: Compare the charges and choose the most cost-effective for your business.

- Multi-currency: Choose the gateways that support multiple currencies for numerous international transactions.

- Integration: You must ensure that it should easily be integrated with third-party platforms for seamless experiences.

Frequently Asked Questions

-

Are there any countries restricted to use international payment gateways?

Yes, countries, such as Iran, Cuba, North Korea, Syria, and Sudan restrict using international payment gateways. It is essential for merchants to check the laws and regulations before performing any payment gateways.

-

How long does it take for a payment to be processed through an international payment gateway?

The payments are processed in a matter of a few minutes or seconds. However, it depends on how credit cards and payment methods take time to accept payments. As they have their own days and processing fees to complete the process.

-

What types of payment methods do international payment gateways accept?

Following are the types of payment methods international payment gateways accept

- Debit cards

- Credit cards

- Bank transfers

- ACH transfers

- Digital wallets

- Cryptocurrencies (limited to a few)

-

What fees do international payment gateways charge for their services?

International payment gateways charge a monthly fee, setup fees, and transaction fees. However, the fees vary depending upon the type of transactions and the association of payment gateways.

Choose the Right Payment Gateway for Your Business

Selecting the best international payment gateway could be tricky, confusing, and challenging. However, with careful consideration of specific needs and preferences, you can select international payment gateways for your business.

With the above list of 10 payment gateways, we hope you are now able to choose the right payment processors for your business.