Are you finding it a challenge to manage payments for your business and want to:

- Save time in manually generating bills and reaching out to customers.

- Provide a convenient and timely method for customers to settle their recurring liabilities.

- Offer customers greater security by encrypting the information.

You have come to the right place. You can put your billing process and payment cycle on autopilot by setting up automatic payments.

Here’s a blog that will help you learn

- How to set up automatic payment system for your business

- Answers 3 most asked automatic payment questions

If you are willing to leverage automated payments to attain a reliable solution for your challenges like invoice errors, cash flow monitoring, missed pay-outs (for subscription box services), and financial reporting, this article will be the ultimate guide for you.

So, what are you waiting for? Start right away.

Contents

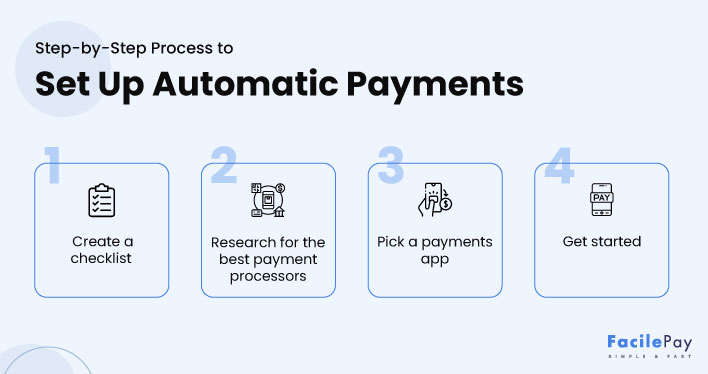

How to Set Up the Automatic Payment Schedule for Your Business [4 Steps to Get Started]

For both companies and customers, automatic payments work as the most convenient way to receive client payments, making the billing and payment cycle efficient. There are many benefits of recurring transactions that can be maximized only with automation. However, accepting client payments on autopilot will require you to know the process to set up automatic payments and understand your to-do’s for the same.

Here is a step-wise guide for you to simply follow to get started and achieve the desired solution.

-

Make a Checklist of Your Requirements

- Your service/product type to identify whether to opt for fixed or variable amount auto payments

- Your end goal or objective to set up automated payment (whether you want to achieve better cash flow monitoring or manage missed or late payments from your customers)

- Your feature requirements from the automatic payment service provider such as currencies to accept payments, methods to collect payments, cash flow monitoring, and payment information security

- Your budget or cost capacity to process payments

-

Do Your Research for the Best Payment Processing Applications

- If you are facing trouble managing the billing cycle for your customer’s recurring invoice, you need software that gives you accounting like Zoho and offer recurring payment solutions.

- If you are facing challenges in accepting payments and maintaining track of it, then you would need a dedicated payment processing software with an automatic bill pay solution like FacilePay.

- If you are struggling to manage recurring invoicing and payment both, you need an automatic bill payments software like Square.

-

Pick the Payment Processor That Best Fits Your Requirements

- Your requirement checklist

- Your research of the best payment softwares or merchants

- And, the end solutions you seek to achieve for your business model

-

Set Up Automatic Recurring Payments

- Select the invoice for the auto pay

- Select the targeted person for the auto pay from your customer directory [you can set automation for only a specified number of customers in one go]

- Select the subscription package/service/product from your item library

- Set the payment schedule for your recurring payment type

- Select the payment method you accept in the automation panel

- Select the option of payment retries for missed or late payments [here you will get the option to enter the number of times you want the retry failed payments to take place automatically]

- Choose the method by which the reminders and confirmations for automatic payment processing services will be sent

- Preview the set automation details

- Schedule and start the automation

-

What Types of Businesses Benefit From Automatic Payments?

The types of businesses that benefit from billing and payments automation are mentioned below.

- Subscription/Membership-Based Businesses

- Financial Services Providers

- IT/Software Companies

- Streaming Service Providers

- Legal Services Providers

- Utility Services Providers

- Real Estate Businesses

- General Contractors

- Automobile Businesses

- Freelance Creatives

-

How Does Accepting Recurring Payments with an Automated Schedule Helps Businesses?

Here are the 4 in-depth benefits of accepting recurring payments with an automated schedule.

- Boost Customer Retention With Client Convenience

You can boost your customer retention with the auto-pay option enabled. Customers are always looking for the quickest and most convenient ways to do things. Paying invoices online in an automated manner brings efficiency and ease of use, and ultimately satisfaction.

- Reliable Cash Flow With Long-term Client Relationships

When you have satisfied clients or customers, you are definitely having a predictable and reliable cash flow for your business. The reason is more customers prefer to stay with you and use your product/services with a recurring fee to pay on a specific schedule automatically. The long-term client relationships boost your business growth and help you scale faster.

- Automated Payment Reduces Errors and Saves Time

Automating payments for recurring billing reduces errors and saves a great amount of time for the accounting software team. You can maximize your accounts team output with this method in place.

- Equipped to Scale Faster With Predictable Business Revenue

As mentioned already, you can scale faster with the automation and recurring payment structure in place. Happy clients mean longer relationships and better cash flow that you can predict to scale.

- Boost Customer Retention With Client Convenience

-

What Should You Consider for Setting Up Automatic Payments?

There are seven important aspects that you as a business should consider when setting up automatic payments.

- Able to accept recurring payments for multiple methods

- Able to accommodate a wide range of currencies to ensure customers from all geographical locations can pay

- Able to auto-generate your invoices

- Security factors to keep customers’ payment information safe

- Able to set up reminders for debit/credit card payments online

- Flexibility with pay schedules

- Easy process to cancel the automation

If you keep these aspects in mind, you are in the right direction and can maintain great customer relationships.

The first step to start setting up automatic billing and payment schedules will require you to create a checklist of your requirements. Now, the question comes, ‘what to list as requirements for automatic payments?

Well, get to learn the key areas to cover for your requirement checklist from below.

Listing down these requirements will give you a start and a guided path to move ahead.

As soon as you conclude with your requirement checklist, you need to start researching the best payment processing applications or software in the market. Without a processor, you cannot set an automatic payment for your subscription services or create recurring payment platform. Thus, finding the best automatic payment merchant will be the ideal route for you.

Now, how to find the best processor or software to get paid automatically for client purchases. “The best” always depends on your individual feature requirements and end goals to achieve. Below are some examples to refer and understand for conducting your research tactfully.

Examples to Guide You in Evaluating ‘The Best’ Payment Software for Your Business –

When researching the best payment processing applications, get answers to the below questions.

| Questions | Sample Answer |

|---|---|

| What are the challenges you are facing with billing and payments? | Late payment fees for subscription based services, failed recurring credit card payments due to expiry issues, paying a high transaction fee for accepting credit card payment from customers, and so on. |

| What are the solutions you are expecting from your recurring payment services provider? | Standard monthly fee for automatic billing and payment processing solution, online payments, security for client’s personal data related to credit/debit card, simple and quick auto pay set up for all recurring payment types, automatic retries for missed payments, reasonable per transaction fee, payments monitoring, and so on. |

| What is your budget for the application software to automate payments? | Standard monthly fee with no additional or hidden charges on credit/debit card and online payments. |

| How can the automatic payment merchant benefit your customers? | It should help customers achieve payment convenience and should be very secure ensuring no data of bank transfers or debit/credit cards gets stored. |

Getting answers to these questions will guide you in your research for the best payment software to automate your transactions and invoicing.

Now is the time to make the decision. Once you have identified the challenges, pick the best payment processor as per your business needs. You have done enough analysis and research in the above steps. This step will require you to actually begin with the process to set up automatic payments for your business.

Your decision should be based on the following:

To guide you further, below are some top softwares or processors mentioned that can help you set up variable or fixed amount auto payments in all methods for various subscription box services.

List of the top payment processors in the market

| Top Billing and Payments Software | Description |

|---|---|

| Square | Square is one of the best softwares in the market for automatic bill payments. Brands of all sizes and shapes trust Square to accept payments. This software got featured in Entrepreneur, The Next Web, SC Magazine, and so on. |

| FreshBooks | An integrated accounting and automatic payments software built for any business size helping 30+ million large and small businesses. This saves up to 553 hours equivalent to $7000 in billable hours each year. It’s accredited as the top software for accounting and accepting automated payments by Capterra, PCMAG.COM, G2, and Software Advice. |

| FacilePay | An all-in-one app for accepting automatic payments trusted by 1.75K people for their business. It’s simple, efficient, and cost-friendly features have helped it earn 4+ ratings in Android and Apple app stores. |

| Zoho Subscriptions | An integrated billing and payments software crafted for powering subscription businesses. It helps efficiently automate the entire subscription billing cycle and has got the most secure payment gateway suite integrated such as Stripe and PayPal business account. Zoho subscriptions won the 2019 great user experience award and was accredited by Capterra, GetApp, and Software Advice. |

| QuickBooks Online | A cloud based accounting software and automatic recurring payments software for most small businesses. It is rated 4.3 by Forbes Advisor. |

Hope this above market overview will help you make the right decision for your business. Now, let’s move to the next and last step of actually setting up automatic payments.

Once you have completed all the above steps, you will now need to actually set up automatic payments in your chosen software. But, how to do it?

Well, every billing and payment software has different instructions and a checklist to follow for setting up automatic payments. However, in order to give you a basic idea and an overview, below is the generalized instruction guide provided.

Generalized Instructions to Set Up Automatic Payments

Note: These instructions are general and will vary depending on the software or application you use for automated invoicing and payments.

From the above, you have already gained a detailed understanding of the steps to set up automatic payments for your business. Let’s explore some of the most asked questions by businesses like you before you begin executing the things learned so far.

Ready to Automate Recurring Payments? 3 Most-asked Questions to Answer Before You Begin

The above are some of the most popular categories leveraging the most from payments automation. There are many more types and forms of businesses entering into the recurring payments structure like grooming providers [example – Dollars Shave Club].

Got Your Questions Answered? Set Up Automatic Payments Securely

So, you are now set to begin with payment automation for your business. Automating payments is a win-win for every business, irrespective of size and type. Having this option eliminates manual challenges and also helps keep your customers happy. After all, what matters to you as a business is your clients/customers. If they are happy, you are growing.

This blog tried to cover the aspects that are involved in the process of setting up automatic payments for recurring billing. If you are willing to try out a secure and easy-to-use payment processor, then consider using FacilePay.