- Recurring payments can be set up on PayPal for businesses that want to offer automatic billing to their customers.

- Businesses need to have a PayPal business account to enable recurring payments on their website.

- PayPal offers different types of billing cycles, payment frequencies, and payment amounts to suit different business needs.

- Businesses should communicate their billing policies and procedures clearly to their customers to avoid any misunderstandings or disputes.

📝Key Takeaways:

Being a business offering subscription plans for a predictable revenue stream, you need a payment solution that supports billing your customers at set regular intervals.

Now, you might want to support your recurring billing cycle with a payment solution like PayPal. But, this will bring the following questions.

- How to set up recurring payments on PayPal

- What to consider before starting with PayPal recurring payments?

- How to identify if PayPal recurring payments will work for the business type and serve the purpose?

- How much will it cost to set up recurring transactions on PayPal?

You have come to the right place to clear your doubts and answer your queries.

No doubt, PayPal is one of the best processors to use for automated recurring billing and payments. However, there are a set of things you should be aware of before starting to use it.

In this blog, you will learn about:

- How to set up recurring payments for your business on PayPal [step-wise process]

- Things to know about setting up recurring payments on PayPal before actually getting started

- How much does processing recurring payments on PayPal costs?

- Top alternatives to PayPal for recurring payments

So, are you ready to dive in? Let’s start right away.

Contents

- How to Set Up Recurring Payments on PayPal for Your Business [A Step-by-step Guide]

- Things to Consider About PayPal Recurring Payments Before Getting Started

- How Much Does Setting Up Recurring Payments on PayPal Cost?

- Which are the Top Alternatives to PayPal for Recurring Payments?

- Frequently Asked Questions About PayPal Recurring Payments

- Set Up PayPal Recurring Payments for Your Customers Easily

How to Set Up Recurring Payments on PayPal for Your Business [A Step-by-step Guide]

PayPal is one of the top processors in the market for collecting payments that fall under a subscription plan or subscription billing structure. You can easily set up and cancel automatic payments using a PayPal business account. Here is the stepwise process for you to get started.

How to set up recurring payments on PayPal [Quick Overview of the Steps]

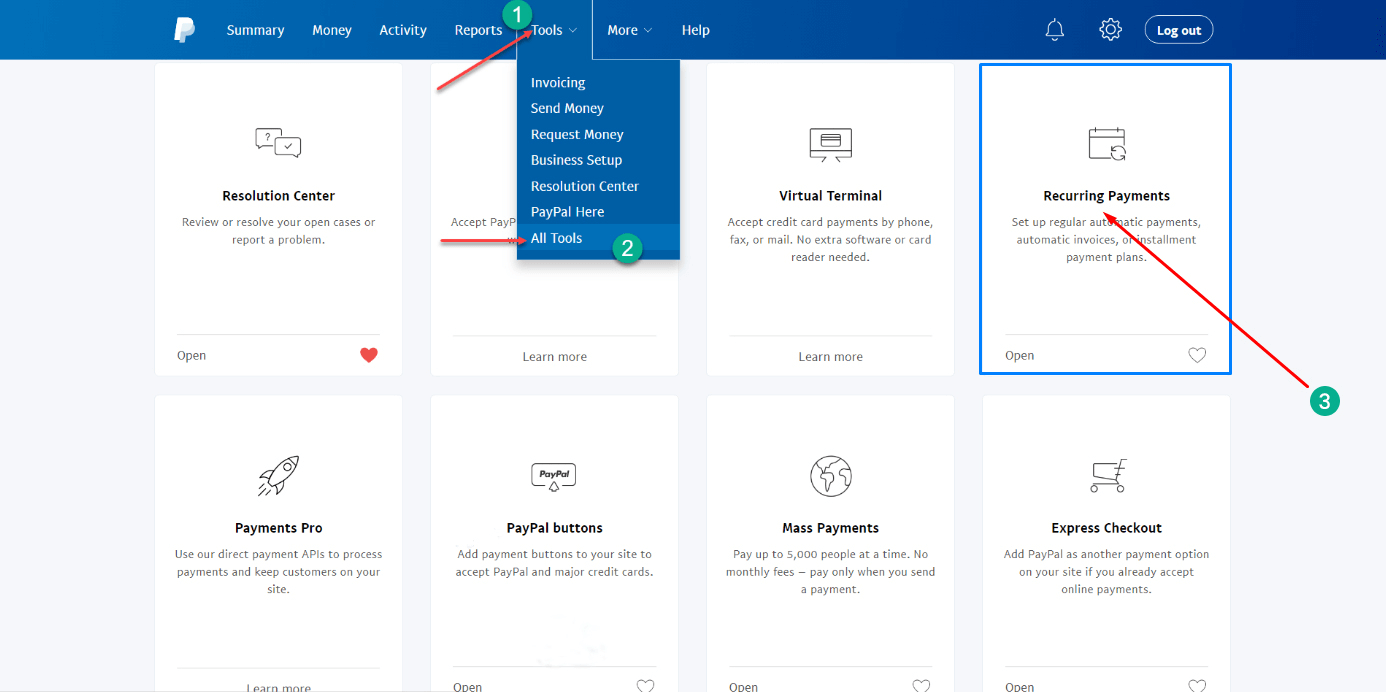

- Step 1. Log in to your business or premium account from the PayPal website.

- Step 2. Click on ‘All Tools’ which is visible at the top of the page and select recurring payments.

- Step 3. Click on my customer’s list from the recurring payments dashboard and select the customer’s name you want to bill.

- Step 4. Click on the bill now button in the automatic billing details screen.

- Step 5. Enter and save the recurring payment details in the dialog box for automatic billing and click bill now/start series to begin PayPal payments.

Now, this is a quick walk-through of the setup process on PayPal. Explore and understand the steps better from below.

Step 1. Log in to your business or premium account from the PayPal website.

Source: paypal.com

Step 2. Click on ‘All Tools’ which is visible at the top of the page and select recurring payments.

Source: paypal.com

On selection, the recurring payments dashboard opens in your PayPal business account.

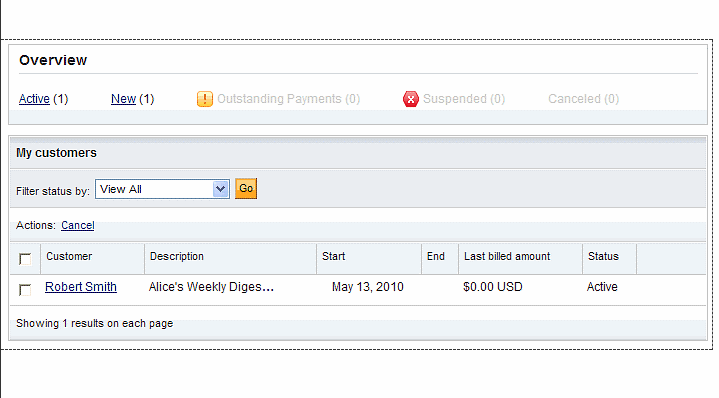

Step 3. Click on my customer’s list from the recurring payments dashboard and select the customer’s name you want to bill.

Source: paypal.com

The automatic billing details page opens in your PayPal business account with an overview of the item/product/service to be billed and the billing limit to follow for the same.

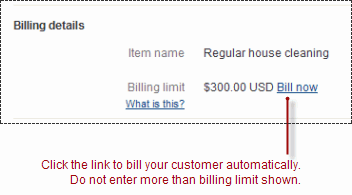

Step 4. Click on the bill now button in the automatic billing details screen.

Source: paypal.com

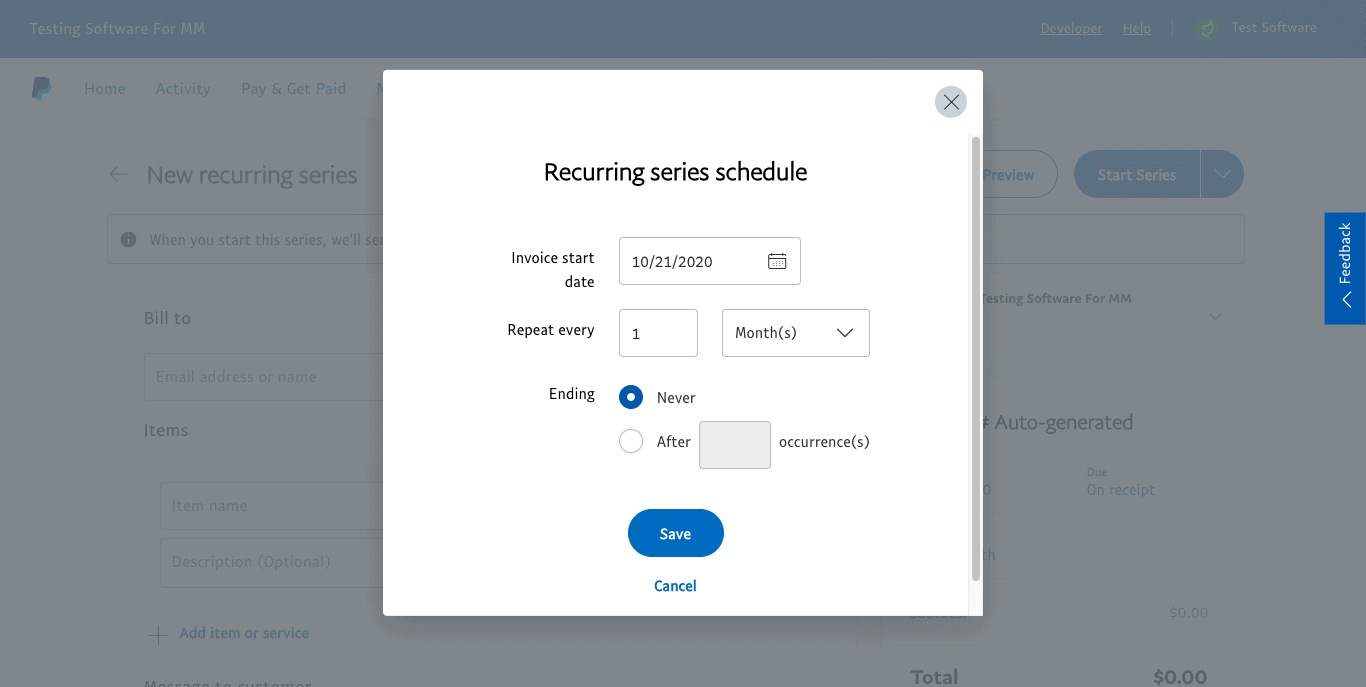

Once you click on the bill now link, a dialog box opens for setting up the automation. You need to enter the payment details like the amount to charge and the frequency of the billing cycle.

Step 5. Enter and save the recurring payment details in the dialog box for automatic billing and click bill now/start series to begin PayPal payments.

Source: paypal.com

Following the above steps, you can successfully set up recurring payments on PayPal for a fixed pricing module or a variable fee structure. If you are a business with a website or an app using the PayPal express checkout for recurring payments, then you might need to set up the subscription payment button in your merchant account.

However, the overall process of setting up PayPal recurring payments is quite direct and simple.

Things to Consider About PayPal Recurring Payments Before Getting Started

When you decide to start charging your customers on a recurring basis using PayPal, you need to first learn about the customer experience with this checkout process. After all, you can only maximize your earnings with recurring payments when your customers are happy and satisfied.

Let’s quickly look at some facts to consider when opting for PayPal recurring payments.

- Inconvenient Checkout Process: Your customers need to either have a PayPal account or create one to complete the transaction for a billing cycle.

[If you are a SaaS business or have a subscription model that requires customers to approve the recurring payment, then your customers need to log in to their PayPal accounts (either personal or business) to complete the transaction process.]

- Potential for Customer Churn: Your customers are forcefully redirected to PayPal’s website for completing a recurring transaction while starting with the subscription plan. Many often drop out at this stage either because of the hassle of logging in to PayPal or the inability to understand the redirections.

- Cost: You can eliminate the possibility of customer churn mentioned above with PayPal’s direct payment API but it is only available to PayPal Payments Pro users (which is pretty much costly).

As a business, you need to consider all aspects and enable the right payment option for your customers. Think keeping your customers at the center of focus

How Much Does Setting Up Recurring Payments on PayPal Cost?

PayPal is a payment gateway and a subscription billing solutions provider processing 90+ currencies. There is a lot of bifurcation of the costs charged by PayPal to process payments based on the country and the features.

On average, PayPal charges around $10 a month for recurring billing and payments. If your checkout process needs PayPal Payments Pro, then you might need to pay a further $20-$30 every month. There are charges on each transaction based on the payment method used as well.

With the above costing in place, you can decide your best fit for billing and payments solution. Apparently, if you have a business with a huge number of subscription customers and a good cash flow from this model, then PayPal can work perfectly for you. You can achieve security and convenience both from this billing and payments solution provider.

Which are the Top Alternatives to PayPal for Recurring Payments?

Here are the 3 best recurring payment alternatives to consider over PayPal.

| Logo | Top Alternative App to PayPal | Features of the App |

|---|---|---|

| Stripe |

|

|

|

|

PayU |

|

| Square |

|

For businesses dealing with recurring payments for a flexible or fixed amount, the best solution is to use a payment processor or software having any of the above as a gateway for secured transactions. The reason for choosing a payment processor is convenience and efficiency with less requirement of setting up and scheduling. For example, if you use a payment processor like FacilePay, you are able to get started with recurring payments in less than 1-2 minutes while having your payments processed and secured by Stripe. Isn’t that better than performing this whole setup of recurring payments on your own?

Now that you know the alternatives to PayPal, let’s get some of the popular queries answered on this topic.

Frequently Asked Questions About PayPal Recurring Payments

-

What mistakes to avoid with PayPal recurring payments?

As a business, you can’t take any chances of losing customers. Therefore, you need to avoid making costly mistakes to keep up with the expectations of your customers. With PayPal recurring payments, there are a few mistakes that you should avoid. Here are 3 core mistakes to never make with your customers recurring transactions.

- Not maintaining adequate transparency in the billing process

- Making cancellations difficult for the customers

- Not scheduling dunning emails for payment failures due to card expiry

-

What are the recurring payment models that PayPal supports?

There are two types of recurring payment models that PayPal supports. They are:

- Fixed recurring payments

- Variable/per-user recurring payments

-

What are the different setup options with PayPal recurring payments?

There are three ways or 3 setup options that you as a business can leverage with PayPal recurring payments. Below are the three options mentioned.

- Option 1. Direct integration of recurring payments via PayPal API

- Option 2. Add recurring payments with an embed button created via PayPal

- Option 3. Use a processor supporting PayPal payment gateway

-

What are the benefits of PayPal recurring payments?

There are multiple benefits of PayPal recurring payments. Below are a few core benefits stated for your knowledge.

- Easy to set up that helps save time and effort on the business front

- Brand name and recognition helps gain customers’ trust

- Huge potential customer base makes it easy for the business to leverage payments and earn more

- Ease of execution in payment processing helps complete transactions faster

- Accept international payments that enable reach a wide customer base

- Convenient tracking of transactions makes it easy to view and understand churns

- Helps earn card reward points for setting up automatic recurring payments using credit/debit card

If you have the budget you can build an app from scratch keeping the costs of acquiring all these above factors. Alternatively, you can also choose to register in a payment software or app already in the market with flexibility in feature offerings to cater to your customers.

-

What are the disadvantages of setting up recurring payments via PayPal?

Some of the most challenging areas with PayPal recurring payments are as stated below:

- Hidden fees

- Stringent rules

- Poor customer service

- No third-party arbitration

- Painstaking verification process

- Chargeback protection for bad customers

-

Who can leverage using PayPal recurring payments?

Below are some of the popular business types who can leverage PayPal recurring payments. They are:

- SaaS subscription providers dealing with customers globally

- Businesses dealing with subscriptions for coherent courses and tutorials

- Premium subscription plans to Worldwide communities like Quora

- Every business that supports periodic billing

Set Up PayPal Recurring Payments for Your Customers Easily

The above blog topics are aimed to help you get started with your recurring payments setup process. PayPal is a trustworthy option for businesses to set up and process recurring transactions. Additionally, PayPal gives you complete freedom and convenience to anytime cancel subscriptions for any customer. You can cancel your PayPal subscription in 7 easy steps. Isn’t it fantastic? The ease, security, and flexibility that PayPal offers makes it among the top processors in the market. This guide aims to help you make an informed and guided choice. So, are you ready to set up your PayPal recurring payments?

While PayPal is a great payment solution for businesses, there are more options that you can always try out. One such option is FacilePay. Consider using FacilePay if you want a quick payment solution secured by the Stripe payment gateway.