Can’t decide on the payment model to adapt for your business? Confused between fixed recurring payments and one-time payouts?

Well, you are not alone. Deciding on the pricing structure can be the toughest evaluation to perform for businesses.

Ideally, you should evaluate whether one-off payments or recurring payments fit your business based on the below parameters.

- Your unique business type

- Your customers

- Your challenging areas with pricing strategy

- And, what do you want to achieve with a strategic payment structure?

For instance, Adobe has reworked on its business model to scale its business with predictable revenue and a loyal customer base. They shifted from a boxed-licensed software model to a subscription-based structure giving birth to Adobe Creative Cloud.

If you want to make a business move like Adobe, you first need a very clear idea of the two broad categories of payment models available. The thirst for massive change and risk only validates when you have the right understanding and knowledge.

In this blog, you will gain detailed knowledge on one time payment vs recurring payment.

Let’s start with the definitive definitions of one-time payment vs recurring payment in order to begin with this comparison blog.

Contents

- What is One-Time Payment?

- What is Recurring Payment?

- One-Time Payment Vs Recurring Payments: A Comparative Analysis

- 3 Core Benefits of Recurring Payments

- 3 Core Benefits of One-Time Payments

- Frequently Asked Questions on one-time payments vs recurring payments

- Why Settle for One? Leverage the Benefits of Both

What is One-time Payment?

A one-time payment is a one-off transaction of the full amount for owing or accessing a product/service. It is a cost-per-use model where the transaction happens in one go and with a single payment cycle in place.

This model works well for industries that are in the manufacturing and distribution of expensive products such as the automotive industry.

Some product examples that require making only one payment include Apache Server, Microsoft Windows, Google Cloud Platform, Amazon Web Services, and the majority of video games.

In this case, the concept of customer lifetime value is almost non-existent. Here the business and transactions work quite direct.

What is Recurring Payment?

A recurring payment is a repeated or periodic transaction of the full amount in small chunks (predefined) on certain schedules for mostly accessing a product/service. The recurring billing amount and schedule can be both fixed and flexible.

This model works well for subscription businesses like gyms, streaming service providers, and home utility service providers.

The recurring payment and billing model works on the following structure:

- Usage-based invoicing and payments

- Tier-based payments

- Volume-based payments

- Flat rate payments

Examples of products/services that fall under recurring billing models include Dropbox, Adobe, and Netflix.

With this structure in place, you can build a loyal customer base and channelize recurring revenue streams for your business. You can also maximize your outcome by accepting recurring payments online (via direct debits).

One-Time Payment Vs Recurring Payments: A Comparative Analysis

| Metric | One-Time Payments | Recurring Payments | Which is a Great Choice? |

|---|---|---|---|

| Predictability | Unpredictable: Revenue and inventory are difficult to foresee or predict. |

Highly Predictable: Revenue and inventory can be mapped with concrete numerical figures. |

Winner: Recurring Payment Reason: Better predictability of revenue can be acquired with recurring payments enabling a steady flow of income. |

| Revenue Flow |

Faster Revenue Flow with one-off fee: Revenue is generated all at once in a larger payout. |

Slower Revenue Flow with recurring monthly fee: Revenue is generated in small but consistent installments. |

Winner: One-time Payment Reason: Faster flow of revenue will be there with this model helping to earn lump-sum at a go. |

|

Invoice Processing & Management |

High Efficiency: Processing invoices and managing transactions is easy and efficient. Quick: Raising invoices and collecting payments doesn’t take time and works seamlessly quick. |

High Efficiency: Processing billing cycles and automated recurring payments are easy and efficient. Easy to Manage: Managing automated billing cycles and payments are simple and efficient. |

Winner: One-time Payment Reason: This work great for in-store businesses and small transaction cycles while recurring payments work for bulk invoicing and management helping to cater to a wide range of users together. |

| Error Handling & Management |

Easy & Quick to Fix Invoicing Errors: Fixing errors with entries in the invoices is easy and quick to perform. Complex Invoice Management System: Managing large numbers of invoices can be tedious to handle and has scope for errors on multiple layers with the heavy labor of the accounts team. |

Less Efficient with Invoice Error Fixes: Fixing small billing errors in the existing, payments cycle can be tedious and time-consuming. Efficient Invoice Management System: Managing automated recurring revenue billing cycles is easier and more efficient with less scope for errors. |

Winner: Tie Reason: Both payment structures have their pros and cons, however, the automated process works better in terms of efficiency on a holistic level. |

| Revenue Projection | Tedious & Time-consuming: Accurate revenue projection and data-based tracking and analysis of payments cycles can be difficult to perform, and may consume a lot of time and effort from the finance team. | Simple, Efficient & Accurate: Accurate revenue projection and payments gap tracking and analysis can be obtained at regular intervals with utmost efficiency. |

Winner: Recurring Payments Reason: Recurring payments work as a better choice for efficient and accurate revenue projection. |

| Churn Rates | Low Churn Rates: Customers make one-off payments on a cost-per-use structure. This model doesn’t have scope for churn or loss of revenue. | High Churn Rate: Customers can drop out from their subscription plans and cancel automated recurring payments anytime amid their billing cycle. |

Winner: One-time Payment Reason: One-time payment close a deal in a single transaction cycle and so less churn rate as compared to the recurring model. |

| Customer Lifetime Value | Low Customer Lifetime Value: Customers pay a lump sum amount in one go for the product or service they purchase and it remains uncertain whether they will return or not. Hence, lower lifetime value. | Higher Customer Lifetime Value: Customers authorize recurring fees for access to a product/service because it is convenient and financially bearable. This brings higher customer lifetime value and lower acquisition costs. |

Winner: Recurring Payment Reason: Recurring payments engage customers in a long relationship with the brand and lead to higher lifetime value. |

This comparison will give you clarity on the ways each model works and how they can help your business. But, who is the winner between the two models can’t be answered here. Why? Because the best fit will depend on your unique requirements.

While some can take the advantage of both, others might need to decide on one. Having that in mind, the core benefits of subscription and recurring billing process is detailed out below. Explore now and gain better insights.

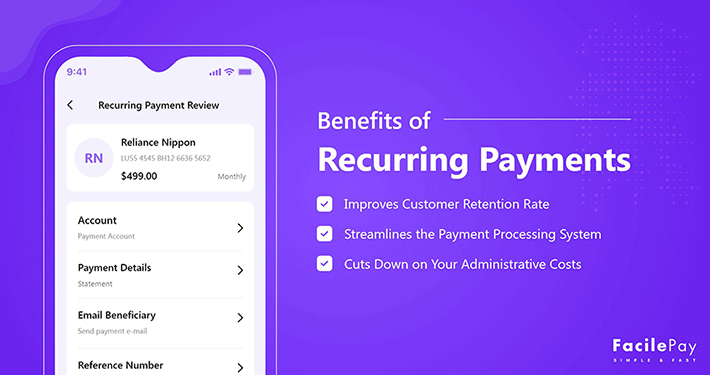

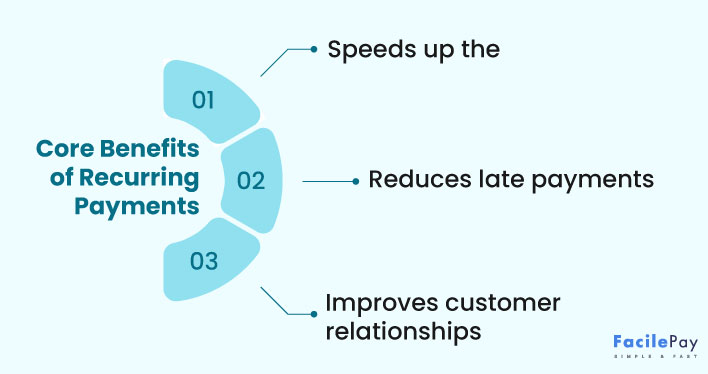

3 Core Benefits of Recurring Payments

When speaking about recurring payments, there can be various benefits. All of those benefits aim to resolve one core challenge and that is “the inconvenience” in the payments and accounting process. While there is one challenge, the one core outcome or solution expected from the variable payments model is “predictability”.

In line with the above context, below are some of the advantages that are driving growth for this model with an average 18% annual rise rate (implying to $1.5 trillion market by 2025 from $650 billion in 2020).

Let’s see what are these benefits.

-

Recurring Payments Speed Up Transactions

-

Recurring Payments Bring Efficiency into the Payment Cycle

-

Recurring Payments Eliminate the Scope of Guesswork Out of Budgeting

Recurring payments work greatly to eliminate the core challenge of “inconvenience” from the payments and billing system. This model helps you automate the billing and payment process through a SaaS-enabled system like FacilePay. Setting up subscription services eliminates manual errors and also speeds up transactions. You set up the billing and payment schedule once and it manages the repetitive cycles accordingly.

Recurring payment method largely saves time, speeds up the process of transactions, and eliminates errors, all leading to better cost management for the business with increased customer retention.

Recurring payments make the funnel of billing and payments more efficient by eliminating manual work, making everything automated, and tracking gaps with detailed data-based insights. As a business, you no more need to chase your customers for payments or spend time working on individual invoices – everything will be done automatically using recurring payment software. You simply need to set up the schedule of payment with the billing details and the rest will be handled by the payment processor every time.

What more can you as a business ask for?

Recurring payments work largely to streamline revenue for businesses. Whether it’s bringing predictability in place with constant cash flow, managing existing assets, tracking churns, or mapping your future financial investments with accurate expense insights, recurring invoices will help you get payments in time.

Recurring payment model helps you to maximize your revenue potential at a minimal cost. You can plan out for the long term with the degree of certainty this model brings to your business. Even if there are sudden churns that can damage the revenue stream, you will track it down instantly and create a backup plan for damage control.

Sounds profitable, isn’t it?

Popular brands leveraging the most out of this model are mentioned below:

| Businesses | Description |

|---|---|

| Netflix | Leading streaming service provider with 222 million subscribers to it as per Business of Apps data helping generate $24.9 billion revenue having a 23.8% year-over-year increase. |

| Disney Plus | Another streaming provider topping the chart with 100 million subscribers generating $5.2 billion revenue having an 85% year-over-year increase. |

| Dollar Shave Club | One of the most successful businesses dealing in consumer products that have benefited from the recurring payments model. It made a $1B subscription box business. |

| Dropbox | This is a cloud-based storage software product that is seeing a 10.25% revenue increase year-over-year. In fact, it has over 14.3 million paid users to it helping it generate heavy revenue. |

| Adobe | Adobe is one the top SaaS industry leaders who have leveraged the maximum from the recurring payments model. The revenue generated through this model stands at a whopping 20% YoY. |

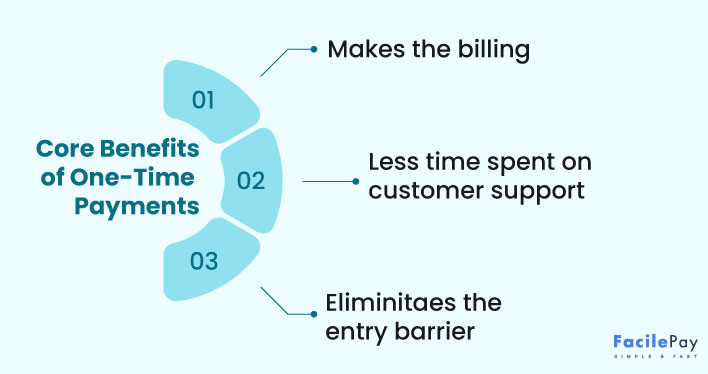

3 Core Benefits of One-Time Payments

One-time payments are usually the most direct and straightforward way of collecting money whether in-store or online. There are not many strategic aspects to it. You simply get paid once and for all. Some of the key benefits of this payment model are stated below.

-

One-Time Payments Enable Quick Revenue Flow

-

One-Time Payments Simplify Providing Discounts on Transactions

-

One-Time Payments Have No Entry Barriers

One-time payments are a simple and quick method of making and accepting transactions. Both customers and the business make a direct deal with no additional pricing strategy and conclude it with a one-off payment. This works largely for making transactions for the delivery of goods or services, payments made for food in restaurants, and expensive automobile purchases. You simply pay the money and buy the product or service with this model in place.

Getting discounts on payments is simple with one-off payments. Many times to promote a product or service among the target market and to attain healthy customer relationships, businesses provide discounts on in-store or online purchases. These discounts are easy to implement with one-time payments.

For instance, shopping from Flipkart during the big billion days can be an example of this.

The one-time payment model removes the entry barriers for customers and provide them with more versatility in their choices. For instance, with a one-time payment business model, you don’t have to necessarily enroll for a payment plan to access the features of a product like Canva. This model offers the flexibility of choice and does not put them into a prescribed plan.

Frequently Asked Questions on One-time Payments vs Recurring Payments

-

Is it mandatory to adapt to only one payment model?

No, it isn’t mandatory to adapt to only one payment model. A business can leverage the benefits from both one-time payments and recurring payments. But, it should know how to make this intersection of two varied payments model work simultaneously. For example – Amazon Web Services has the option for one-off payments as well as subscription-based plans.

-

What is the best payment model for an eCommerce business?

The recurring payment model is garnering a lot of popularity among eCommerce businesses. Most eCommerce businesses are now accepting a recurring fee for their products or services in addition to one-off payments. Many businesses are even shifting entirely to a subscription-based model. For example – Amazon Prime.

-

How to Choose the best payment model for your business?

Every business is unique in nature. The payment model you choose largely depends on your business goals in the long run. While one-time payments are quick and easy with a direct revenue generation process, recurring payments work with short and steady cash flow at regular intervals for the business with better scope to scale.

Why Settle for One? Leverage the Benefits of Both

With both payment models in place, it can be understood that each has its own pros and cons to add to your business. If you want to maximize your profits with a good and strategic payment model, all you need to do is leverage the most from both.

Your customers might have different payment capabilities that you will only get to know with some tweaks in your existing methods of collecting payments and upgrading to a more strategic version.

FacilePay can be your dedicated payment processor for both models. It works to bring convenience, security, and flexibility to your approach of accepting payments.

So, are you ready to scale your finance team efficiently and retain customers for long-term relationships?