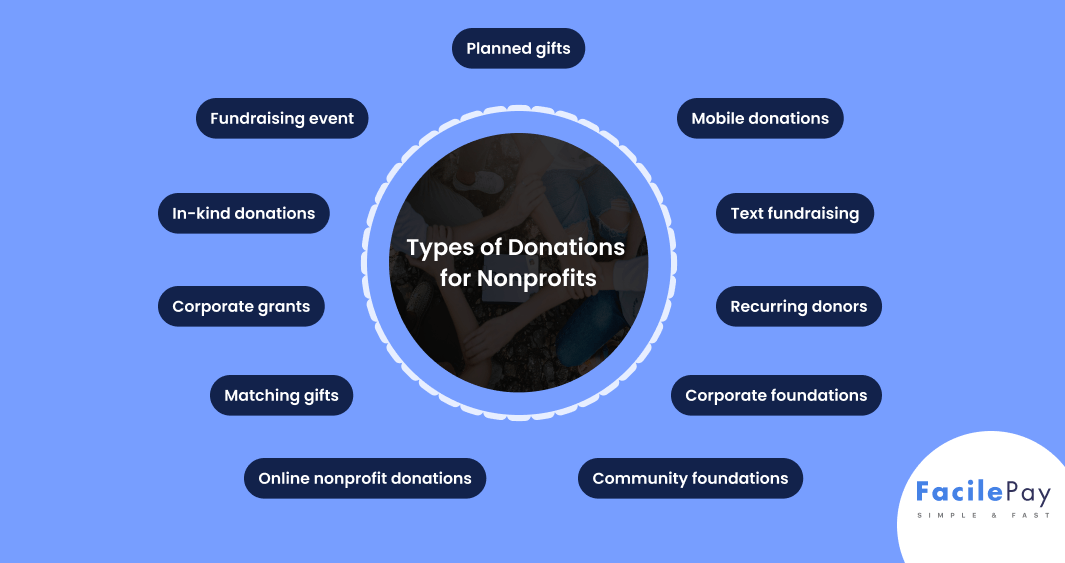

- Nonprofits can receive different types of donations, including one-time, recurring, in-kind, and major gifts.

- Each type of donation has its benefits and challenges, so nonprofits should choose the ones that align with their mission and goals.

- Donors can give online or offline, and nonprofits should offer various channels and methods to make it easy for donors to give.

- Building relationships with donors, providing transparency, and showing impact can encourage more donations and support for the nonprofit.

📝Key Takeaways:

Donations are an essential part to help nonprofits or charities to sustain the fundraising opportunities and events to achieve their mission. Without the help of donors, many nonprofit donations would struggle to make a meaningful impact in their communities.

In this blog, we’ll explore the various types of donations that nonprofits can receive, including cash donations, in-kind donations, planned giving, major gifts, fundraising events, and crowdfunding. We’ll discuss the benefits of each type of donation, provide examples of how they can be made, and explain how they can help support nonprofit organizations in achieving their goals.

By understanding the different types of nonprofit donations available, you can make informed decisions about how you can best support the causes you care about and make a positive impact in your community. Whether you’re an individual donor, a corporate sponsor, or a foundation grantmaker, there are many ways to give back and help nonprofit organizations thrive.

Contents

-

Let’s find out.

- Individuals

- Corporations

- Foundations

Each of these categories offers something different in terms of online donations. We will discuss each one of them and the type of planned nonprofit donations they offer.

Category 1: Individuals

72% of donations come from individuals. This term is what people think of when they say “donors” or think about fundraising. Below are the different types of nonprofit donations that individuals make to charitable organizations.

1. Online nonprofit donations

There are multiple online donation forms readily available for free to give to their favorite nonprofit organization. They do not have to distribute grants or pull out cash to match donations. The whole process generally takes not more than a few seconds.

Online donations are a great way for donors to give easily and efficiently. If your nonprofit has an online donation form, make sure that your donors know about it and can access it quickly. You won’t be able to collect those online contributions if your supporters don’t know where to find the form!

2. Mobile donations

To take online auctions or planned donations a step further, let’s consider mobile donations. Mobile giving is the new type in local businesses of one-time donations with a substantial amount. With traditional online nonprofit donations, donors can only make donations when they have laptops. But with a mobile donation, you can donate from anywhere via any mobile device.

Part of what makes mobile fundraising accept donations is its adaptability. There are several ways to offer mobile giving.

Nonprofit donations using QR codes

A QR code can also direct users to your donation page. Donors can make a donation by scanning the code with the camera on their phone, which will direct them to a payment form.

Any visual medium can be enhanced with QR codes to offer a cashless donation option or make it simpler to set up recurring payments. For instance, you may include a QR code in your online movies, social media posts, and event fliers and posters.

Social media fundraising

Platform-specific charity tools are available on social media platforms like Facebook’s Charity Giving Tools and Instagram’s donation stickers and fundraising campaigns.

3. Text fundraising

Text-to-donate

Donors can use text-to-donate to ask for a donation link by sending a keyword to your SMS number.

Donors fill through a brief form to enter their payment information after getting the link by SMS, and they then confirm the payment via email. Any organization can now provide a straightforward, sequential approach to making a donation on a smartphone.

Text-to-give

Text-to-give enhances the convenience of mobile giving, but only if your organization satisfies a few criteria. This simple and successful fundraising strategy can help any nonprofit group, but it works especially well for:

- Nonprofit groups that provide emergency aid frequently need to raise a lot of money quickly.

- Also, churches employ text-to-give (also known as “text-to-tithe”) as a technique to complement or take the place of their conventional collection plates.

- Text-to-give fundraising is frequently advantageous for educational institutions like schools, NGOs, and colleges.

- Text-to-give is a technique used by political campaigns to encourage supporters to pull out their phones and donate while also promoting voting.

4. Recurring donors

Recurring donations not only give your nonprofit a reliable source of income but also make the donor experience simple.

By giving donors the choice to make regular nonprofit donations, you empower them to help your nonprofit in the way that best suits their needs and save them the time of having to visit your donation page repeatedly.

Also, compared to a one-time donation, donors may be able to give more over the course of the year. If the nonprofit donations are rather tiny, don’t be discouraged—they pile up rapidly and might result in more money donated altogether!

Why is it important to keep donors and pull in customer retention?

The lifetime return of a regular donor is higher than that of a one-time donor. Here are just a few instances showing how effective a program for recurring donors is:

In the first six months, 75% of donors will stick to their budget, and many of them will continue to give for years.

Recurring donors make additional one-time gifts within a year of signing up. compared to one-time donors, 75% more often

The size of the typical one-time donation is greater for contributors who have recurring plans.

How can you take recurring donations via the internet?

The majority of online fundraising platforms, like FacilePay, let you collect recurring contributions from your supporters. Make sure your donors have access to this option by checking the settings on your contribution page.

Other systems can also be used to gather regular donations. For instance, the payment processors PayPal and Stripe both let you add a recurring contribution option to your donation forms. Also, Facebook lets your donors set up regular nonprofit donations.

5. Fundraising event

Events can be fantastic chances for your contributors to get to know one another and your organization better, even though raising money at them isn’t the easiest way for organizations to earn revenue.

A fundraising event is just one more opportunity for your nonprofit to raise money, whether you hold a formal gala, a fun day for the whole family, or a standard walk-a-thon. The money can be raised either in advance through peer-to-peer, through the sale of tickets, or even right at the event!

6. Planned gifts

Donations that are anticipated but made in the future are known as planned giving. Donors who desire to make a planned donation to a charity frequently state their preference and organize gift programs.

Frequently, nonprofits are aware of major gifts well in advance. Prior to making the gift official in their will, the donor would typically state their preferences and speak with the charity to match donations.

Sometimes perhaps a donor’s prior nonprofit donations or connection with the organization are the sole sign that a planned gift will be made. Planned gifts frequently range in size and are made by people with a personal connection to your organization. The donor might have already donated, might be into volunteer grant programs, or might have used your organization’s services like employee donations, or cash gifts.

Category 2: Corporate giving programs

7. Matching gifts

Another way organizations demonstrate their fundraising event which is tax-deductible and by matching employee donations. It is sure that not every company can match employee donations, they can only submit the gift raised through corporate giving programs.

When an employee makes corporate donations, they submit a matching gift to the company’s HR department. The organization will match the gift at a 1:1 ratio. The matching gift programs are released and cleared with the original donation. It is an easy way to potentially raise money without asking employees to donate again.

8. Corporate grants

Many companies will offer nonprofit donations to eligible nonprofits at different levels from local businesses to international. The online donation forms are time-consuming, but working with a corporate private foundation is worth the work. Companies are willing to demonstrate CSR activities and it is the easiest way by awarding volunteer grants to eligible nonprofits.

9. In-kind donations

Much like mutual funds, stock donations, or much more like these come from non-monetary sources. In-kind gifts are another example that includes goods, volunteer grants, professional services, or rent-free spaces.

In-kind donations help political organizations meet their goals without spending more. If you have a quarterly fundraising goal to host, you might need a venue to host the fundraising events and maybe a winery can rent you a space for free. Or online auction can save a lot of money.

Receive in-kind donations to make a difference that does not have any monetary assets to spare.

Category 3: Foundations

10. Community foundations

The area that community foundations serve frequently defines them. Usually, they only give donations to charity organizations that are situated in their designated region.

Several community foundations offer a variety of corporate grants that can be given to specific nonprofits to accept donations. However, although some donations are given at the foundation’s discretion, others call for outreach on the part of the nonprofit.

11. Private foundations

The main difference between private foundations and community foundations is the source of the donations.

While private foundations are funded by an individual or family, community foundations rely on the pooling of resources.

According to their standards and discretion, these private foundations give one-time donations to particular charitable organizations. While some will provide funding to a wide range of NGOs, some grant money to only one kind of organization.

Although the application process requires time and work, it is well worth it if your nonprofit organization is awarded a grant from a private foundation.

12. Corporate foundations

We’ll touch briefly on corporate foundations to complete the foundation category. Although these kinds of foundations are frequently connected to the parent firm, they are regarded as autonomous and independent organizations for tax purposes. The same laws and standards that apply to independent foundations also apply to them.

So all the above donations were one of a kind when it comes to donating to nonprofits and charitable organizations.

Are you worried about these taxes being taxable?

Let’s find out.

Donations for Nonprofit Organizations- Are They Taxable?

Some types of donations are tax-deductible and other may not be. At the least, what you need is a tax-exempt organization to do charity to be potentially tax-deductible.

Below, we will discuss the top 5 types of donations that are tax deductible or may not be.

- One-time donations: These contributions are tax deductible. Most people are able to donate up to 60% of their adjusted gross income to organizations that qualify.

- Recurring donations: Donations that come in regularly are treated the same as one-time donations.

- Stock donations: In fact, they are qualified to deduct 100% of the full fair market value of the stock when they give it from their taxes.

- Planned donations: These are deductible from taxes, but the amount depends on a number of variables, including the type of gift and whether the donor is still alive.

- In-kind gifts: These donations are tax deductible. A signed recognition of the donation from the nonprofit is required for an in-kind donation to qualify.

-

Pro tip: Tax deductions are a challenging subject. Only the high-level points discussed above were covered. To learn more, go to IRS.gov. The website provides information on donations from both the contributor and beneficiary sides, page after page.

Frequently Asked Questions

-

Is my organization eligible for donations?

Most likely, yes. Nonprofit organizations that have been recognized by the IRS as tax-exempt 501(c)(3) organizations are generally eligible to receive tax-deductible donations. However, there may be certain restrictions depending on the type of donor or the type of donation. It is always a good idea to check with a tax professional or legal advisor for specific guidance related to your organization’s eligibility.

-

How do I get more recurring donors?

There are several ways to encourage donors to give regularly, including:

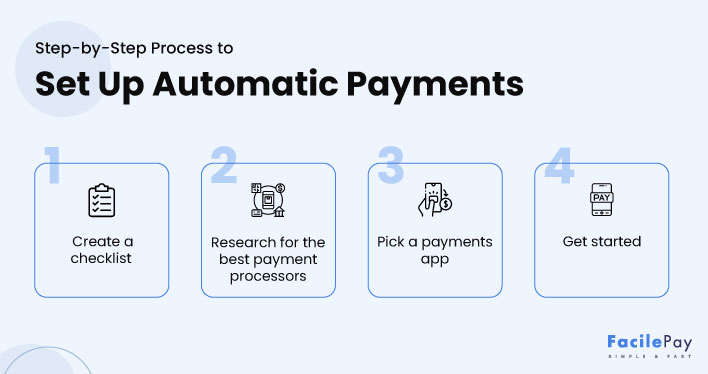

- Make it easy for donors to set up automatic monthly donations through your website or donation platform.

- Use storytelling to show the impact of recurring donations on your organization’s mission.

- Create a sense of community among recurring donors by offering exclusive benefits or recognition.

- Regularly communicate with donors to update them on the impact of their donations and to express gratitude for their ongoing support.

-

How can using a donation form help my nonprofit accept donations quickly and easily?

A donation form on your nonprofit’s website allows donors to give easily and securely, without the need for paper checks or phone calls. Donation forms can also be customized to collect important information from donors, such as their contact information and preferences for recurring donations. By using a donation form, you can streamline the donation process and make it easy for donors to give whenever and however they choose.

Final Thoughts

Giving supporters the freedom to donate, however (and anything) they choose is a wise fundraising strategy. Providing a variety of giving alternatives has the dual advantages of increasing the impact of one-time donations and fostering a sense of gratitude among your supporters, which may encourage them to make additional donations in the future.